/ / / Risk Premia

Risk Premia

Introduction to Risk Premia

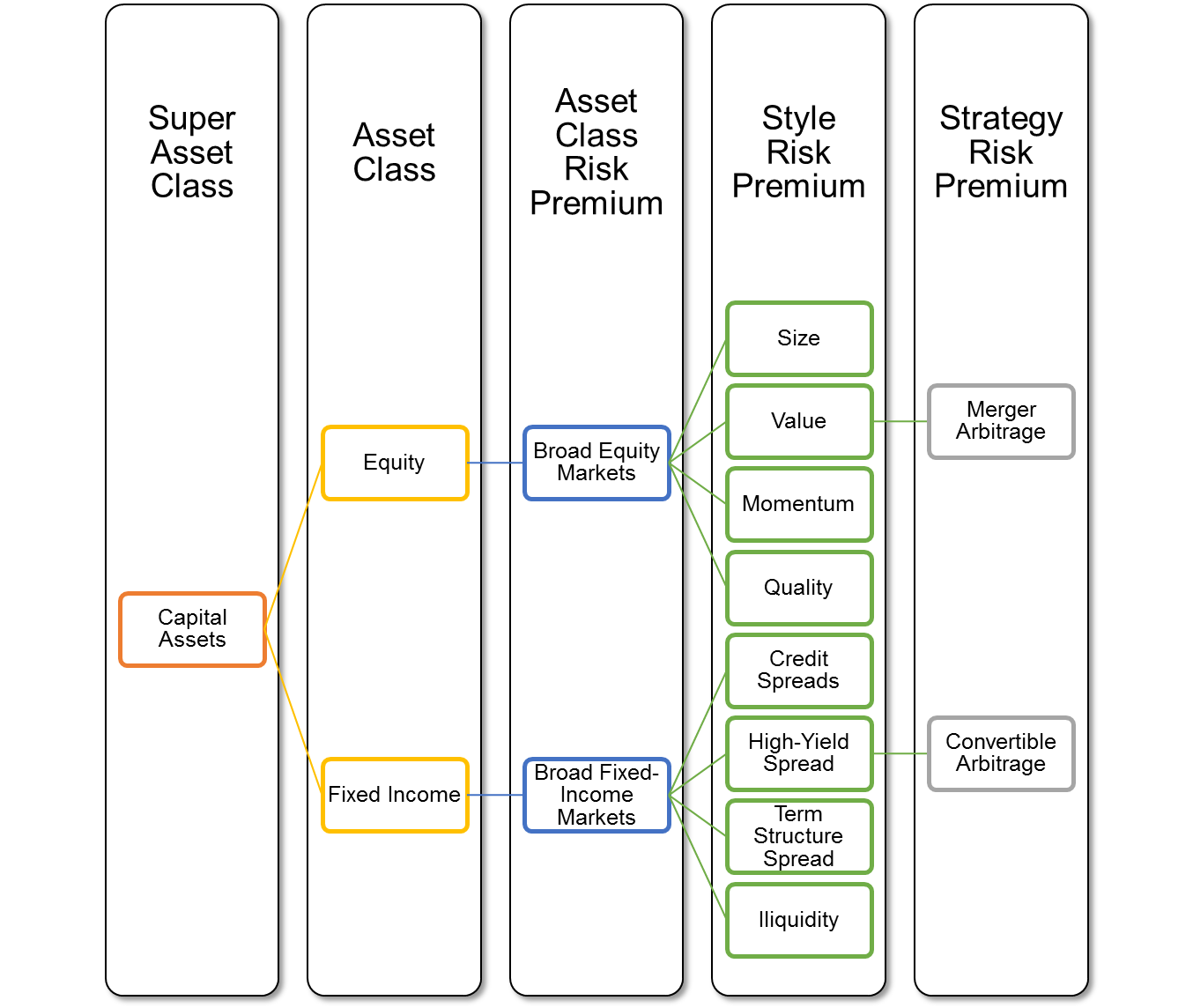

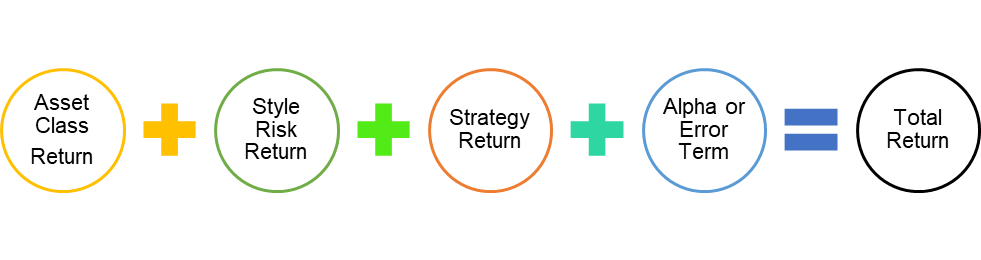

Risk Premia already exists. It is just lumped together in broad assets classes such as equity, fixed income, property etc. We can see risk Premia as the return one should expect to earn for bearing the systematic risk inherent in the investment. One can classify risk premia broadly into three categories, namely asset class, style or strategy risk.

The asset class risk premium is the well know traditional risk premium one expects to earn from the asset class over and above a risk-free rate. In South Africa a rule of thumb is to expect to earn around 6%-8% over risk-free rate for equities over a long-term cycle (Hassan & Van Biljon, 2009).

Style risk premium is another form of return that is well documented and commonly used in portfolio construction at fund level, such as in the core-satellite approach. We derive the style risk premium via intentional exposure to certain fundamental or technical factors.

Examples of style factors are value, growth, momentum, large cap, small cap, term structure spread, credit spread, high yield spread, volatility, and liquidity..

The strategy risk premium is generated by the strategy used to extract return. Classical examples are long-short, merger arbitrage or market neutral strategies.

Table of Contents

- Introduction to Risk Premia

- Categories of Risk Premia

- Alpha Migration

- Reference or Additional Material

Figure 1: Categories of Risk Premia

Alpha Migration

Reference/Additional Material

Portfolio of Risk Premia: A New Approach to Diversification

Jennifer Bender, Remy Briand, Frank Nielsen and Dan Stefek

The Journal of Portfolio Management Winter 2010, 36 (2) 17-25

https://jpm.pm-research.com/content/36/2/17

The Equity Premium And Risk‐Free Rate Puzzles In A Turbulent Economy: Evidence From 105 Years Of Data From South Africa

Shakill Hassan, Andrew Van Biljon

https://ideas.repec.org/a/bla/sajeco/v78y2010i1p23-39.html