/Education-section/Overview/

Auxiliam Platform - 1000 Foot Overview

We aim to help

Auxiliam is here to be your auxiliary system to help you maximize your life utility. Key point is we are auxiliary, we support you; we do not dictate to you, nor do we make mission critical decisions about your life for you. You must do the work, we just provide you with the best of breed industry solutions, information, and support services to enhance the probability of you achieving success.

We are not for everyone; we have a clearly defined customer in mind. Before explaining what we do, it is important to be clear for whom we offer a service. You need to balance your life equation, by choosing from unlimited options but constrained by limited time. Whether we can be of assistance depends on two factors: how self-reliant, you are and your openness to change.

Table of Contents

- We aim to help

- TIME - The limited rigid yet flexible commodity

- The Intersection - Abundant Choices and Limited Time

- Diagram 1 - Customer Classification quadrant

- Customer Classification quadrant

- Are we of value to you?

- Auxiliam Sections

- Auxiliam Sections Continued

TIME - The limited rigid yet flexible commodity

Time is the greatest constraint, broader choices, constant stream of “innovation” and the pace of modern life makes it impossible to consider every option and analyse every piece of information even if it would be beneficial.

Time is both rigid and a flexible commodity, it is rigid in the sense that you only have 24 hours’ day and is a zero-sum game.

Time is flexible in the sense that not all decision gets the same amount of time; we tend to spend more time on important decisions. Some purchase decisions are enjoyable planning a vacation, and others are not such as selecting a lawyer for a divorce.

Ultimately, the weightiness of the decision determines the amount of time one needs to allocate making the decision. When it comes to personal financial planning and working to achieve your life goals few decisions can be heavier.

The Intersection – Abundant Choices and Limited Time

This results in an intersection between abundant choices and limited time, creating two issues that are critical to your decision-making process.

The first is how open to change are you, are you open to free uptime to explore multiple alternatives, or will you try to limit your time and effort and hence your choices?

The second choice is how open are you to leverage your time by relying on others. Are you self-reliant or will you call for advice?

Diagram 1 Customer classification quadrant

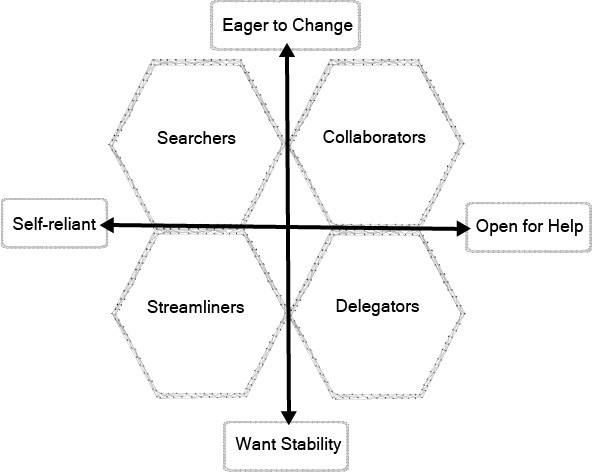

Think about your own openness for change and willingness to accept help and then classify yourself into one of 4 types of personalities as depicted below.

Customer classification quadrant

People we call Searchers are those who are very self-reliant and not willing to accept help think of a gourmet chef that shops for his own ingredients plans and prepare a meal.

These are the people that are open to new ideas and are self-reliant and more importantly willing to spend a lot of time on a task and like the technical details and want to understand exactly how things function what the possibilities are.

They want to feel in charge and want to participate directly. They are driven by curiosity, like to be in the forefront and make their own decisions.

The Streamliners are still self-reliant but prefer stability like a person that goes shopping once a month and eats the same TV-dinner day after day. Streamliners are self-reliant, but tend to eliminate variety to spend as little time as possible on deciding. They want choices narrowed and form buying patterns easily.

The Collaborators are willing to change and open for help. These are persons that would go for dinner rather than cook a meal but would spend hours reviewing restaurants, even calling in to discuss the options for the day before picking a restaurant and then spending time reviewing the menu before making a choice.

Where in the lower right bottom is the Delegators, the person would prefer to order take-away from the same restaurant that knows his preferences for delivery. They are help seeking change adverse buyers who delegate as much as possible. They prefer not to spend time and would like to be involved as little as possible in the decision making.

If you see yourself more as a Delegator, we are not your best option, unfortunately you might be in the majority of the population we are not geared to be of value to you. If you are a Collaborator, you might find value here, since you are eager to chance it all depends how self-reliant you are. Our offering is highly personal, but it is a low personal touched model. On the opposite end of the spectrum, if you are Streamliner you might be a bit overwhelmed how personal our offering can be with all the choices you have to make. Once you have made the choice, you might find us fitting your needs like a glove. Finally, if you are a searcher, you would be delighted as we offer loads of technical information and plethora options on choice as we are constantly at the forefront of the financial service industry.

</id="one">

Are we of value to you?

If you think we can be of value to your own personality below we give you a quick overview of what we can be of support to you. Auxiliam consists of three main sections, each section in turns focus on the same 11 pillars of a holistic solution.

Knowledge repository perfect for reference and learning at your own pace, either reading it ended to end or online read up on a section where you want to enhance your knowledge. Think of it as a dynamic online textbook, elaborating economic and financial theory with examples and interactive sections constantly being updated to enhance the reference framework available to Auxiliam users.

Auxiliam Academy is a more structured learning platform with various courses. Where the knowledge repository is a text book, this is more like a class room with a lecturer teaching from the text book with slides and course notes. Structured learning paths, with video lectures, online reading material and practise sections to ensure you master the content and can apply your new knowledge in the real world.

Auxiliam integrated application is a software solution for you to implement what you learned directly into your life. Holistic solution: integrating all your needs for a comprehensive financial plan. From basic budgeting to asset allocation models and tracking your investments, it is not just once off it a life companion guiding you and adapting as your life changes. The application is not live yet; we aim to offer a glimpse to its working to some Alpha testers. If you are keen to join the Alpha program, there are some hints/puzzles scatter across the site, find them, solve them, and you will be added to the invite list.

The majority of the people behind Auxiliam are industry practitioners with advance degrees and postgraduate industry qualifications. The curated content focus on what we believe to be needed to be able to develop and manage your financial situation. In its nature, this is relatively advance material. The 11 sections in brief is setout below.

Auxiliam Sections

Overview

Traditional introduction and give a high-level overview of the material and what each of the other 10 sections will cover. More importantly, it is also where be place background material to explain concepts that most with a degree in economics or finance would know but other would not. So we touch on the basics of economics, finance theory, etc. in the overview section.

Life-Cycle Wealth

Life-Cycle Wealth is one of the cornerstone principals behind the thinking at Auxiliam. As the offering is predominately focused on individual investors or advisor's to individual investors, it is the starting point to understand what one can achieve using this platform. Central to life-cycle wealth is the spreading of the income from one’s economically productive part of your life over your whole life. For the general man in the street, one can break downs the person’s life into three financial stages:

- Stage one is the growing up and getting educated stage.

- Stage two is the working part of a person’s life,

- Stage three is retirement.

The key point in this section is to understand how your life will evolve over time and as a result your needs aswell. This will give you a mental map to start the financial planning process.

Personal Financial Management

The section personal financial management is the more traditional area people think of when discussing your personal finances. For us it is only a small piece of the puzzle but never the less an important first step in drafting your financial plan. This entails collecting information on your personal financial statements, cash flow, assets, debts, liabilities, education, and emergency fund provisions. The focus is on budgeting and the short to medium term-cash flow need and the effective management of your debt.

This information once analysed will indicate if your living within your means, whether your emergency fund is sufficient, and highlight all other demands on your cash flow. From here you can focus on optimizing your debt reduction, planning your financial management more efficiently to start achieving your longer termed financial goals.

Mathematics of Finance

Before we can move on to the investment side, you would need to have a basic understanding of financial mathematics. We have no intention of turning you into an actuary, we will just take the fear out of mathematics. With clear explanations and examples to help you understand your finances at an enhanced level of insight. As the saying goes, a picture paints a thousand words. We will enable you to paint by numbers where algorithms paints a thousand pictures.

Liability Modelling

Liability-driven investing (LDI) is a refocusing of the management of your assets away from an "asset only" approach and to an approach that considers both the assets and the liabilities specific to you and your life goals. This is another departure from traditional low factory financial advise the industry offers, we help you map out your future needs. Once you have mapped out your needs, we convert it into a liability stream. This just means converting your goals and dreams into a list of future expenses. We then model how this list of expenses is expected to behave over time, which is called your liabilities.

Asset Allocation Modelling

Traditional asset allocation is about dividing your assets among shares, bonds, property, and cash. The idea is to maximize return for a level of risk using diversification. We go deeper to explain the underlying nature of each asset classes and propose a more modern framework. The starting point is the three Super Asset Classes:

- Capital assets

- Consumable/Transformable assets

- Store of value assets

We illustrate why the traditional framework has two weaknesses:

- Over allocating to one asset class - Capital Assets

- Ignores an important asset class we see as the fourth asset class - Human capital.

The final step is to blend your asset allocation to invest for returns that will be able to meet your future liabilities as modelled in the liability section.

Auxiliam Sections Continued

Investment Analysis

At this point you will have a clear framework where to invest and how much, now we need to focus on what to invest in. The investment analysis section provides information on how to analyse financial products. Whether you buy a share, investing into a listed fund or buying insurance, it needs to be a systematic process. This section aims to teach you how to do it.

Portfolio Construction

We like process and behaving systematically, portfolio construction is where we tie it all together. At core one should aim to build portfolio's that have maximum exposure to different uncorrelated sources of return, while having a high correlation to your liabilities. Once you understand your liabilities and the correlation with your potential assets, you develop an integrated optimized portfolio.

- Diversification among super asset classes

- Diversified across risk premia and styles

- Correlation with liabilities

- Risk management around insure versus self-insure

Attribution Analysis

Attribution analysis empowers you to understand what contributed or detracted from your portfolio. The analysis is done at many levels:

- Asset allocation decisions

- Manager selection

- Sectors invested in

- Styles, Market capitalization

The aim is to see whether you are on track to achieve investment aims. It also helps to understand the nature of your portfolio. Whether portfolio or components of portfolio is acting as expected. If not, it is an area to focus on correcting.

Risk Management

The theoretical background unpacks the nature and sources of each of the main risks you face. It focuses next on the options to deal with these risks. With specific focus on understanding risk products such as insurance. The models and tools help you to develop an integrated risk management plan.

Action Plans

Planning is the easy part, you need actionable steps to make your dreams and goals happen. This section provides action plans that direct how you will manage your money to make progress toward your goals. Simply knowing what you want will not get you there: you need a real plan to make it happen, with clear goals and actionable steps that can be measured and tracked.

We offer in-depth knowledge where we are light is on legal vehicles and tax regime where you stay. Most of what we deal with is based on sound economic and mathematical principals that only change or evolve gradually. Whereas tax rules and legal environment applicable to you can change overnight. It is not possible for us to maintain a comprehensive up-to-date knowledge repository to build courses and application on. As much as possible we deal with the principals and explain the tax/legal thinking, the actually application you would need to consult a professional that deals with this on a daily basis.